CoinSafe, the digital payments platform developed by LandFi, has announced a partnership with a leading hospitality chain to modernise how high-volume businesses receive, control, and deploy revenue.

Despite operating at scale and in full regulatory compliance, the group had become increasingly constrained by the structure of traditional payment systems. Card networks and acquiring banks retained control over settlement timing, imposed rolling reserves, and introduced unpredictable restrictions that directly affected cash-flow reliability and operational planning.

For businesses processing large transaction volumes across multiple venues, access to revenue is not a convenience, it is operational infrastructure.

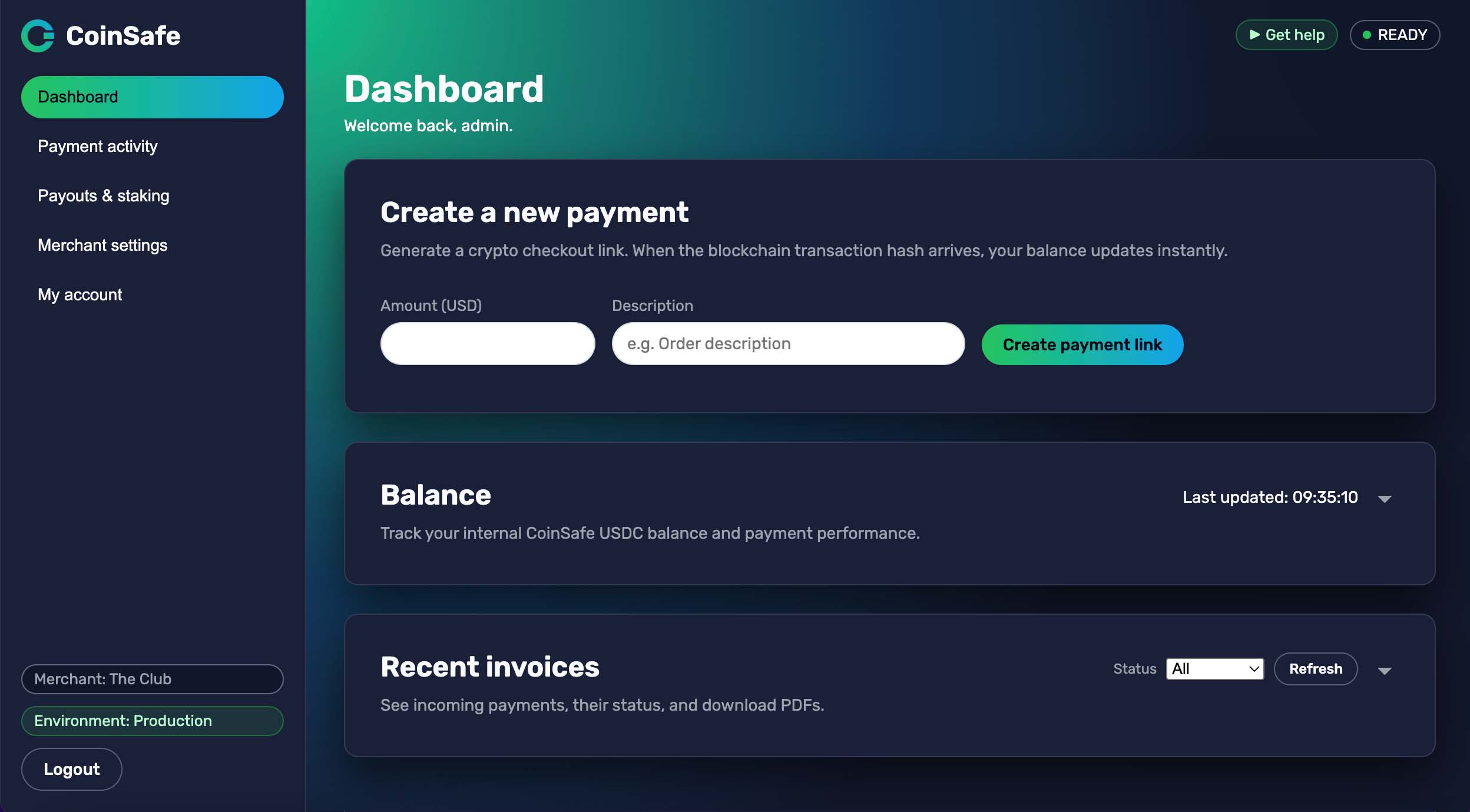

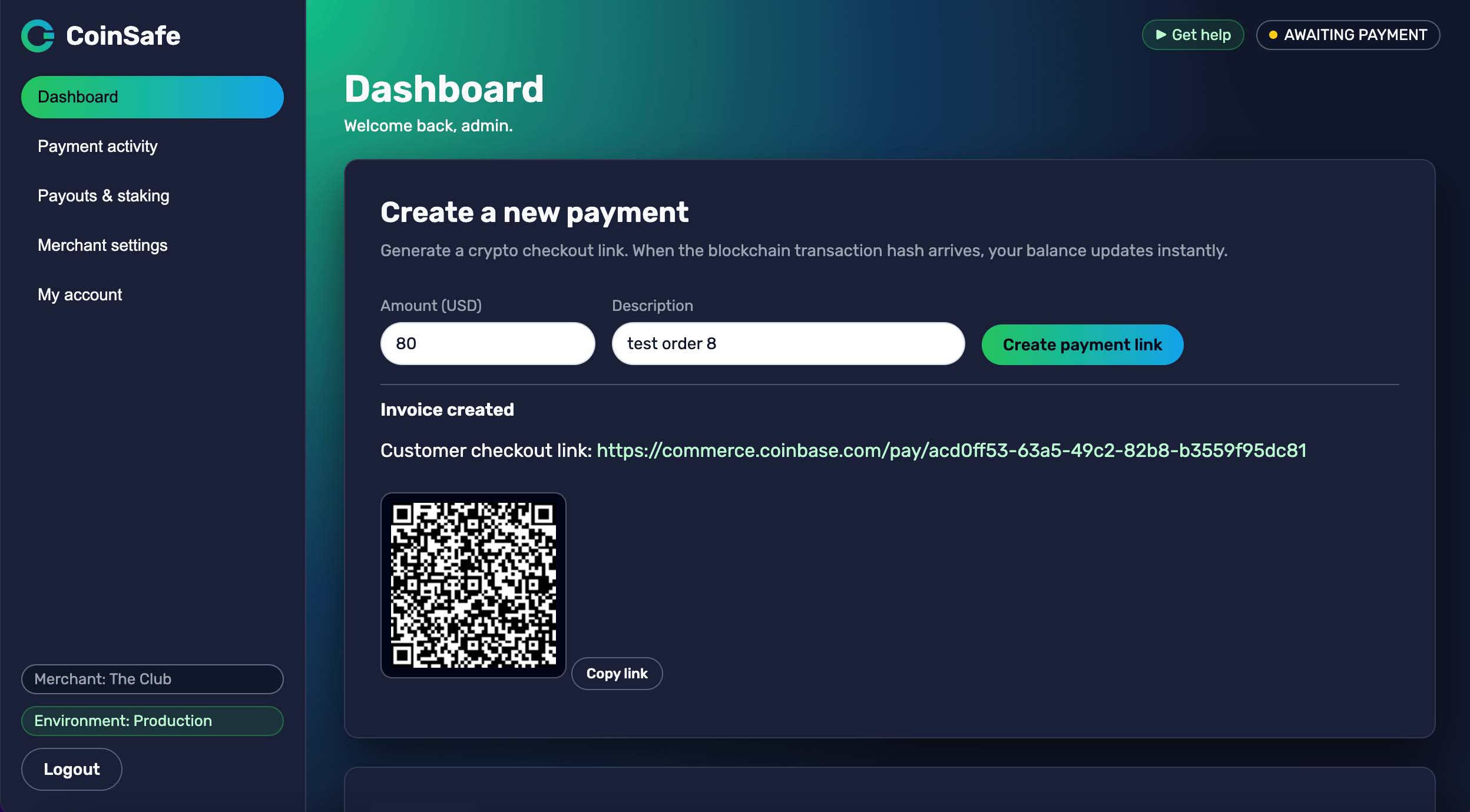

CoinSafe was implemented to replace that dependency.

The structural problem with legacy payments

Modern hospitality businesses operate in real time. Traditional settlement systems do not.

- Revenue is temporarily controlled by payment processors

- Settlement timing is dictated by banking cycles rather than business needs

- Funds can be delayed or held during routine reviews

- Reserves are imposed unilaterally

- Weekend and holiday trading creates artificial cash-flow gaps

- Treasury visibility is fragmented across institutions

Even when a business is profitable, its capital is effectively locked inside systems it does not control.

A new settlement model

CoinSafe introduces a direct digital settlement layer where funds move immediately into infrastructure controlled by the business itself.

This allows the hospitality group to:

- Access revenue in real time

- Remove third-party holding periods

- Eliminate processor-imposed reserves

- Maintain continuous settlement, 24/7

- Centralise treasury management

- Improve forecasting and capital deployment

By using stable digital settlement assets, CoinSafe delivers this functionality without exposure to currency volatility.

Multi-asset payments without balance-sheet risk

CoinSafe supports payments in over 200 digital assets, allowing customers to pay using a wide range of cryptocurrencies while the business itself never carries market exposure.

All incoming payments are automatically converted into stable settlement assets and can be off-ramped directly to traditional bank accounts where required.

For the hospitality group, this provides:

- A single settlement layer regardless of how customers choose to pay

- No exposure to crypto price volatility

- Automated conversion and reconciliation

- Optional fiat settlement into existing banking infrastructure

- Compatibility with existing accounting and compliance processes

This model allows businesses to benefit from modern payment rails without changing their treasury strategy or assuming new financial risk.

Enabling commerce in markets with fragile financial infrastructure

Beyond enterprise hospitality, CoinSafe is designed for regions where traditional banking infrastructure is unreliable, restrictive, or fragmented.

In many countries, businesses face:

- Capital controls and withdrawal limits

- Limited access to international banking rails

- Long settlement cycles

- Currency instability

- Inconsistent regulatory enforcement

- Manual or outdated treasury processes

These constraints reduce foreign investment, slow trade, and prevent local businesses from participating fully in the global economy.

CoinSafe provides a neutral digital settlement layer that allows businesses to receive and deploy capital in real time, independent of local clearing systems, while maintaining transparent records suitable for regulatory reporting.

For governments and regulators, this model offers:

- Improved transaction traceability

- Reduced reliance on cash-based systems

- Greater visibility into commercial activity

- More efficient tax reporting and compliance

- A pathway to modernise payment infrastructure without rebuilding national banking systems from scratch

In practice, this enables economic participation where traditional systems have become a bottleneck rather than an enabler.

Bridging traditional capital and digital infrastructure

CoinSafe is designed to operate at the boundary between traditional finance and digital settlement.

Businesses can deploy funds from conventional currencies such as GBP, EUR, and USD into digital payment infrastructure for instant settlement, then return those funds to the banking system when required.

This two-way flow allows companies to benefit from the speed and programmability of blockchain settlement while continuing to operate within existing accounting, regulatory, and banking frameworks.

In effect, CoinSafe functions as a bridge between real-world capital and modern digital financial infrastructure.

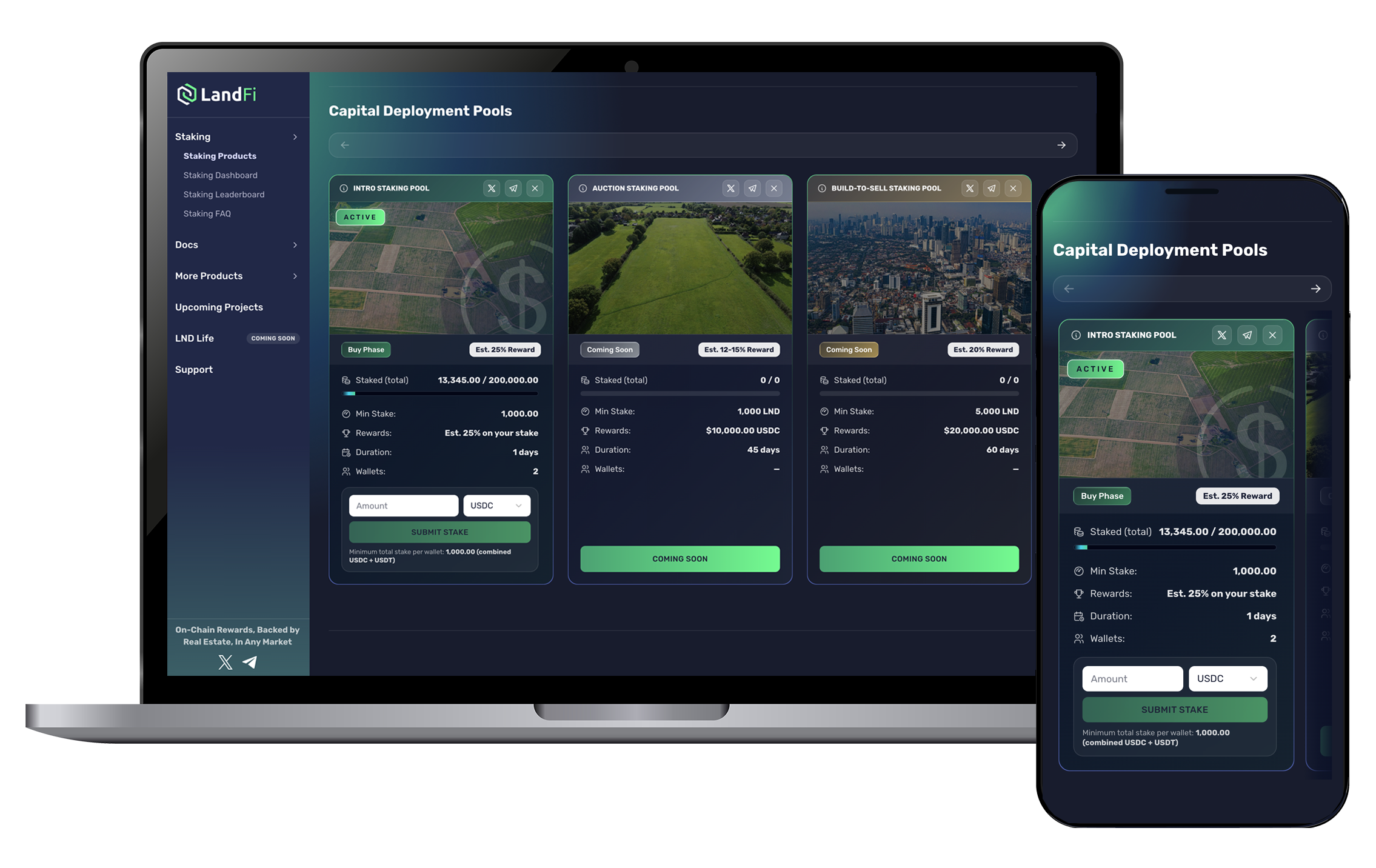

Optional access to real-world asset participation

CoinSafe is also being designed to offer merchants optional access to selected real-world asset opportunities within the LandFi ecosystem.

Participating businesses may choose to allocate a portion of their treasury to revenue-generating real-world assets, such as property-backed transactions, to supplement operating income.

This functionality is entirely optional and separate from core payment operations, allowing merchants to treat CoinSafe purely as settlement infrastructure, or as a gateway to broader capital optimisation tools.

Advancing LandFi’s real-world infrastructure vision

This partnership represents a key milestone in LandFi’s expansion beyond decentralised finance into real-world commercial infrastructure.

CoinSafe is built to serve businesses with payrolls, suppliers, and operational risk, not speculative use cases.

By supporting a global hospitality brand, CoinSafe demonstrates that blockchain-based settlement is becoming foundational infrastructure for modern commerce.